First, your company delivers the goods/services to your client. Then you submit the invoice for acceleration through NowAccount, which is processed, confirmed & approved. Upon approval, Now pays your business 100% of your invoice amount, less the service fee (3-5% of invoice amount). Your client pays Now after 30 to 90 days.

How NowAccount® Is Different

FIXED RATES

NowAccount® is unlike traditional invoice factoring. Now charges a one-time, flat service fee, so you won’t get hit with any surprise interest rates or scary rate escalations; instead, you can enjoy knowing exactly what the transaction fee will be to plan accordingly.

NON-RECOURSE & NO HOLDBACKS

Now also pays you the value of the invoice up front, minus a flat fee, and offers non-recourse funding without an additional charge, so you won’t have any revenue held back until your customer pays, and you’re not responsible for non-payment if they fail to do so.

NO ADDED LIABILITIES

NowAccount® also offers small businesses better terms than other traditional financing and factoring. You won’t have to mark a liability on your balance sheet like traditional financing because you aren’t taking on debt or paying interest. You simply get paid faster, which you book as revenue, and pay a flat fee, which you can then book as a business expense. Your balance sheet remains strong, and in some instances, gets stronger, so if you need to apply for a loan in the future, you’re more desirable to your lender.

USE ALONGSIDE BANK LOANS

Thousands of small and medium-sized businesses use NowAccount® alongside their bank loans or lines of credit. Choosing to use NowAccount® as a financing solution feels just like accepting a credit card from your customer. You get paid quickly with the added bonus of still extending credit to your customers. You know exactly what fee you’ll be charged, and you have the peace of mind of guaranteed payment.

How you get paid changes everything

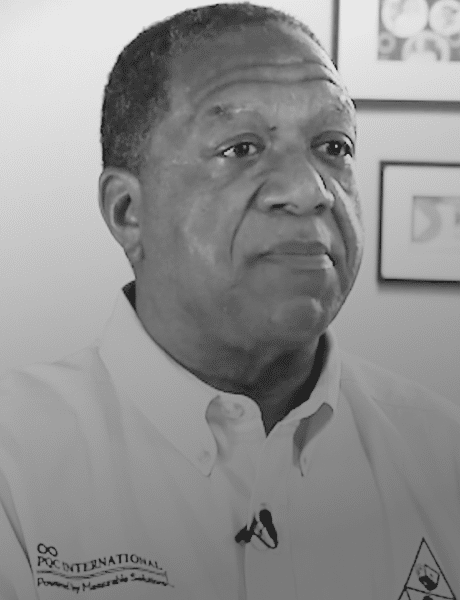

Frank Payne needed to accelerate cash flow to take on more clients. By using NowAccount®, he was able to reinvest in his business and his team to double his revenue.

© Copyright 2021 | Privacy Policy | Terms of Use